First step: Register as a Digital Platform

First, make sure you have registered as a Digital Platform through your HMRC Government Gateway:

https://www.gov.uk/guidance/register-to-carry-out-digital-platform-reporting

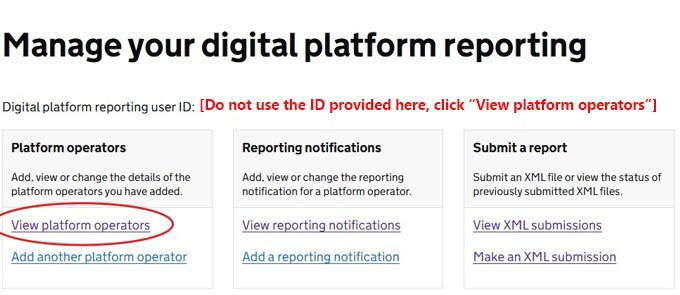

Your Platform ID, which is 15 characters long, will be provided when you register as a Digital Platform through HMRC.

Once registered, you can find the correct ID under "Platform operators" within your HMRC Government Gateway

Enter your Platform ID in Admin > General Details > DAC7 settings alongside your Legal company name.

This will allow you to then generate your XML report and submit your information.

Add a Reporting notification

After adding the Platform Operator (PO), there is an additional step required before submitting your DAC7 report:

Step: Add a Reporting Notification

- Navigate to the PO details and click “Add a reporting notification”.

- This tells HMRC to expect your XML data submission(s).

- At this stage, you can also declare if you wish to take any Due Diligence relief (i.e., only report on Active sellers).

Definition of Active Seller:

A seller is considered active if they received or were credited with any payments during the reportable period, even if they have since been archived.

When to Complete This Step

- HMRC guidance states that this notification only needs to be added once and will roll over into subsequent years.

- However, we have received reports that some users are prompted to add a new notification each year for each reportable period.

- Our recommendation:

- Add the notification when first setting up your PO.

- Check annually in January before submitting your XML to confirm whether a new notification is required.

- You can also add a new notification if you wish to change the reliefs applied or update the nature of the notification.

Checklist - Before you download your report

- All owner statements must be accurate and up-to-date

You will be submitting payment data to HMRC so accuracy is crucial. Ensure all information is correct and current to avoid any discrepancies.

- Enter your company DAC7 details in Admin > General details

Scroll down to the heading DAC7 settings to complete any missing fields. Also make sure you have the correct permissions set for your login access so that you can enter and view DAC7 data. More info.

- Check your Login permission settings

To ensure you have access to download the DAC7 report go to Admin > Login users and select "Access to download DAC7 report" and Save.

- Go through each owner and add seller information where relevant. If no seller information is needed for any owners please select the DAC7 category as Not required for DAC7. If a category is missing for any owner it will prohibit you from downloading the report.

- Check every owner's seller information and tick Due diligence data is correct and verified once you accept that the data is correct. Go to Agency > Seller Validation (DAC7) to easily check data and complete due diligence.

Downloading your XML report and submitting to HMRC

- Go to Agency > Reports > DAC7 Report

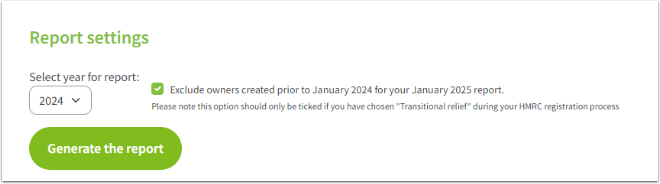

- For January 2025 we encourage you to only send seller information for 2024 owners. For this please tick the box to Exclude owners created prior to January 2024 for your January 2025 report.

3. Click Generate the report. Your report will be generated automatically and saved to your computer's Downloads folder.

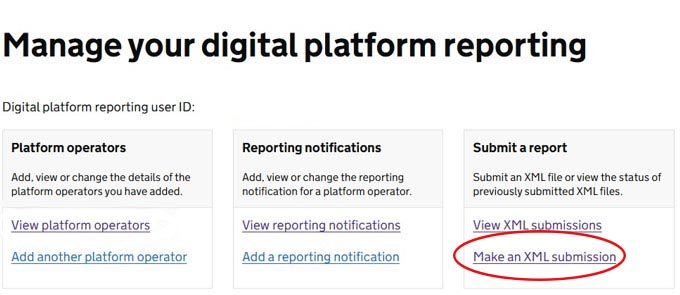

4. Login to your HMRC gateway and go Make an XML submission. Follow their steps and then Confirm and Send to upload your file.

Your XML file will be in your computer Downloads folder for you to select.

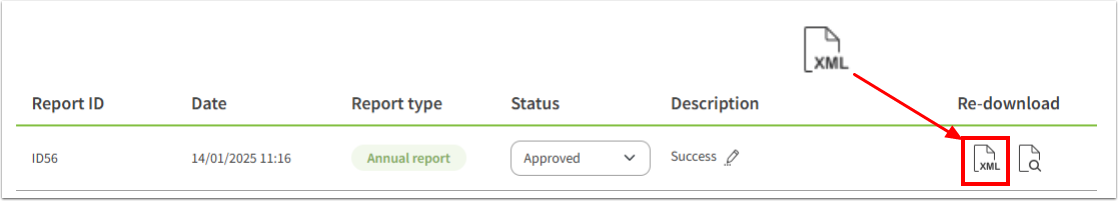

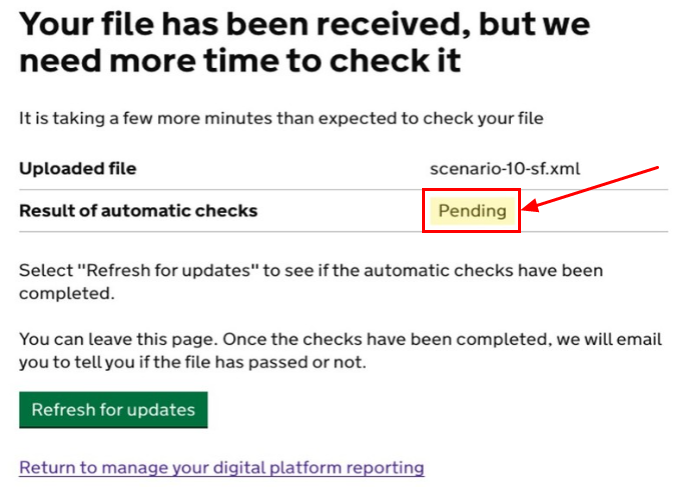

5. Your report will sit in a Pending status (normally around 10 minutes).

You can refresh for updates. Once successful you will receive a success message and a corresponding email

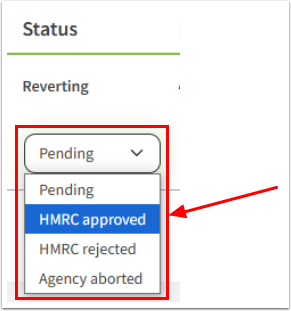

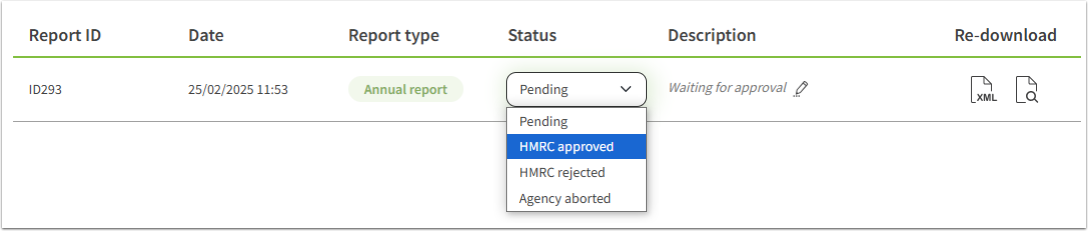

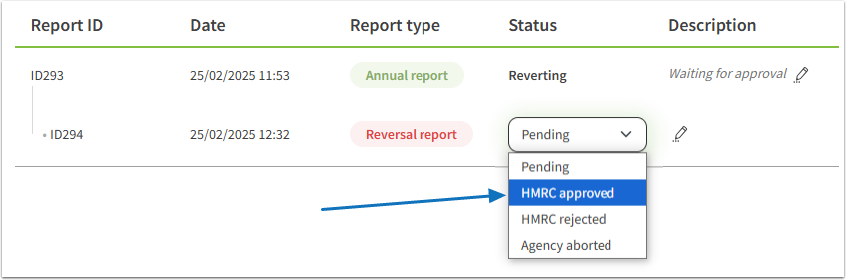

6. In your SuperControl DAC7 report page log your report as HMRC approved.

Click into the box showing Pending in the Status column and then select the option HMRC approved.

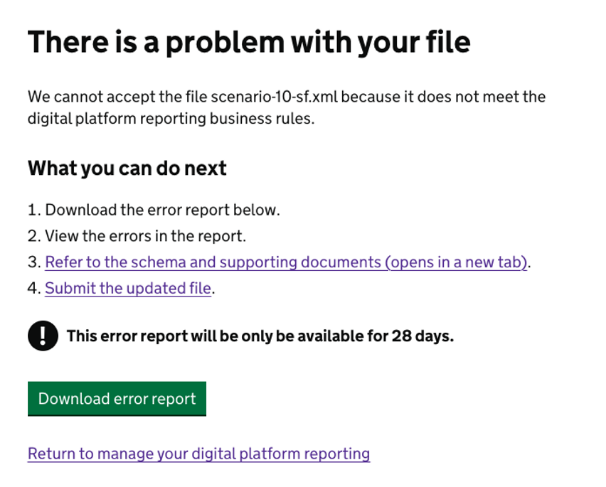

What to do if the report fails the submission

Should the submission not be successful, you will see an error message like the one below:

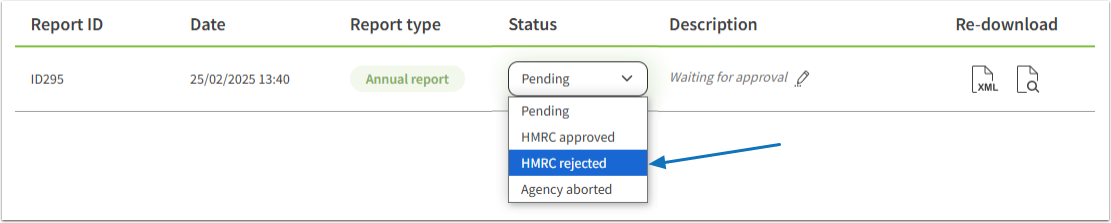

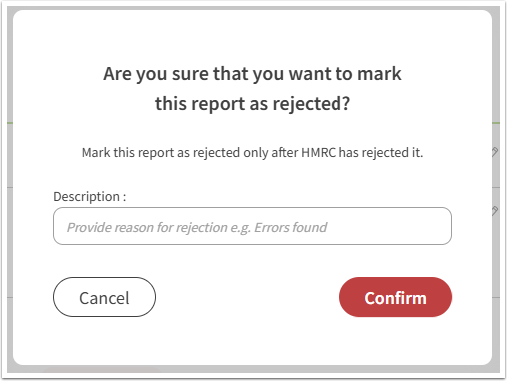

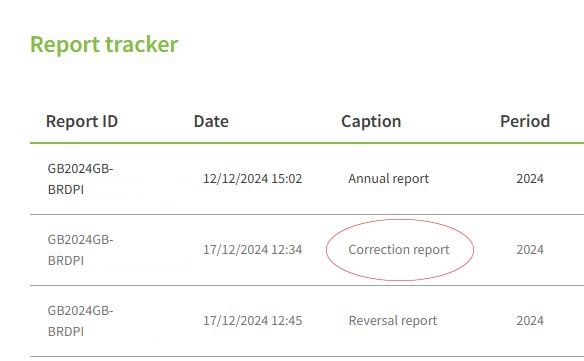

You need mark the report as rejected in SuperControl's Report tracker.

- Go to Agency > Reports > DAC7 reports.

- Scroll down to the Report tracker.

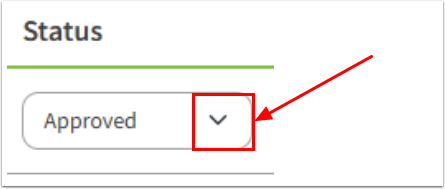

- Click onto the down arrow in the Status column to the right of the report, you tried to submit.

- Select HMRC rejected.

- In the pop-up that will appear, enter a reason why the report is marked as rejected.

- Click Confirm.

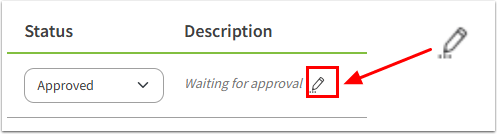

- Click onto the pencil icon in the Description column.

This will allow you to generate the report again at the top of the page, and try another submission once any errors have been rectified.

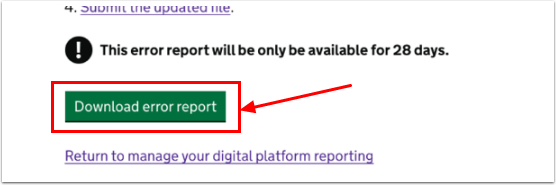

From the HMRC website you can download an error report with further information as to why the report has been rejected.

To do this click the Download error report button on the on HMRC website. When the file has been downloaded you can open it in any application able to display text, e.g. Notepad, Word or LibreOffice. and open the file in Notepad.

If you want us (SuperControl Support) help diagnose the error please send us a copy of the error report only by clicking Download error report on the HMRC page and send it to [email protected].

We will advise in regards to the next steps, if possible.

How to log a successful submission

- In the Report tracker select HMRC approved.

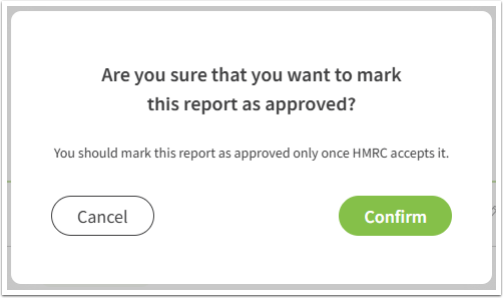

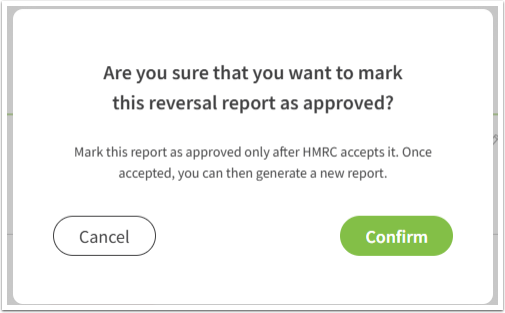

- A pop-up will come up asking you verify that you want to mark the report as approved.

Click Confirm.

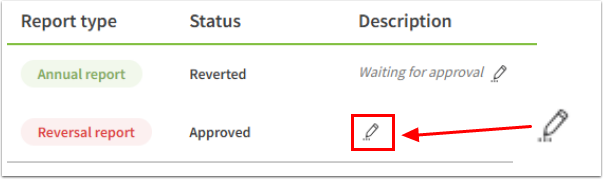

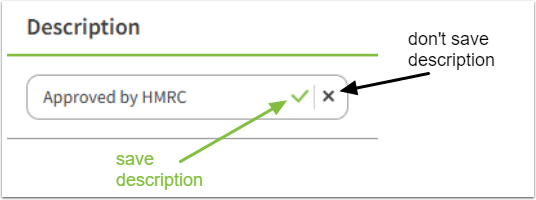

- To add a description, click onto the pencil icon in the Description column.

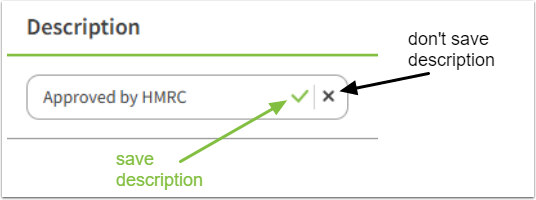

- When the description has been added click the green tick to save it.

Should you decide not to add a description, simply click the cross and no description will be saved.

How to revert an uploaded report if there are changes required

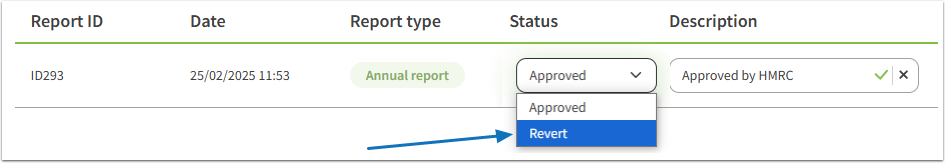

1. In your Report tracker (Agency > Reports > DAC7 report), click the down arrow in the Status column, directly next to where it says Approved.

- From the drop-down menu select Revert.

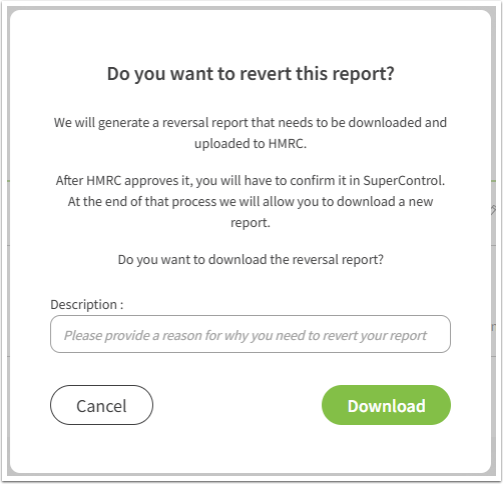

- A pop-up will come up with instructions and an explanation what needs to be done next.

Read the instructions, add a description and click Download.

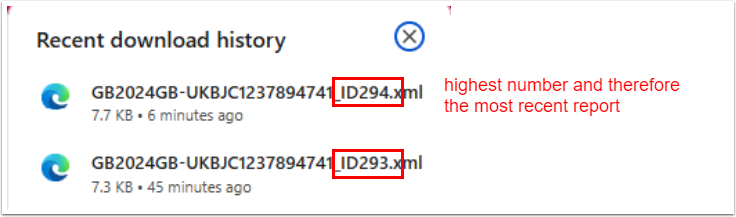

The new report will be automatically saved to your computer's Downloads folder.

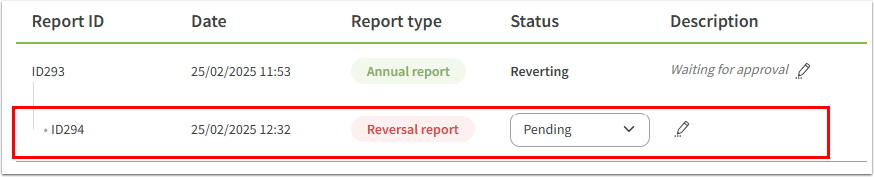

In the report tracker a new entry will be added. The Report type will show Reversal report.

- Upload the newly created report to the HMRC portal like you did with the original report.

- Mark the reversal report as approved in the report tracker by selecting HMRC approved from the drop-down menu in the Status column.

- Click Confirm in the pop-up.

- Add a description, if required, by clicking the pencil icon in the Description column.

- When the description has been added click the green tick to save it.

Should you decide not to add a description, simply click the cross and no description will be saved.

If your reversal report upload is not successful and an error is shown on the HMRC website, please email our support team on mailto:[email protected], quote the error and we can investigate for you.

[CORRECTION REPORTS] What is a correction report and how to submit this

As you are submitting data for a particular year, in some cases adjustments may be made to owners payments that you are duty bound to submit to HMRC. These are known as Corrections.

You will need to submit any correction to HMRC. It is up to you on how often this is done. You can run corrections annually, quarterly, monthly or just when changes are made - it's up to you.

To submit a correction you follow the same process as you did when downloading the annual XML report:

- Go to Agency > Reports > DAC7

- Click Generate the report. The XML report will go to your Downloads folder on your computer.

- Login to your HMRC gateway and go Make an XML submission. Follow their steps and then Confirm and Send to upload your file.

HMRC then requires time to check the file and either accept or reject the file depending if any errors are found. You can check for updates on the HMRC page to track the progress of your report submission.

The caption will automatically be labelled as a Correction report in your Report Tracker, helping you stay organised and easily track each report

Frequently Asked Questions

- Where is the financial information for my owners sourced from?

We gather the information from your owner commission statements, which include money recorded as paid to the owner. - Can I edit the XML before uploaded to HMRC?

No. We automatically populate the data based on what is recorded in SuperControl. The purpose of an XML is that is it a structured file format to exchange data between different systems. In the case of the DAC7 report, the XML file holds the data you need to submit to HMRC, structured in a way that their system can read and process. - If my file submission fails, what do I do?

Please send a copy of the error report that will show to you in your HMRC gateway and send it to [email protected]. We can investigate and provide the next steps.